After your car accident in Temecula, every aspect of your life may seem like it’s turned upside-down. You may no longer be able to work or enjoy your favorite hobbies and activities. You may also have serious injuries that will change the course of your future. If the wreck wasn’t your fault, you may be entitled to compensation to help cover the costs of moving forward.

Ryan Sargent and the team at Sargent Law Firm Injury Lawyers have seen firsthand the impact a sudden accident can have on the lives of those involved. Our dedicated Temecula car accident lawyers are well-versed in California car accident cases, and we aren’t afraid to fight for your right to compensation.

We show up every day with passion, empathy, and dedication to pursue the best possible solutions for our injury clients. If you suffered injuries in a car accident, our Temecula personal injury lawyers can work with you to pursue fair compensation. Call us or contact us online to find out more.

Why Choose a Temecula Car Accident Lawyer at Sargent Law Firm for Your Case

After a car accident in Temecula, hiring the right lawyer isn’t just helpful—it’s essential. Whether your crash happened on Winchester Road, near the Promenade Mall, or along the I-15 corridor, you need a local legal team that understands the unique challenges of car accident claims in this region. At Sargent Law Firm, we combine local knowledge with statewide results to deliver the legal support you need when everything is on the line.

We Have Local Experience That Matters

Our attorneys are deeply familiar with Temecula’s traffic patterns, high-risk intersections, and the way insurance companies handle cases in Riverside County. We don’t need to guess how local courts operate—we’ve worked in them. That local insight helps us build stronger cases and move faster when time is critical.

While we’re based locally, our track record spans across the region—including major results for clients in San Diego, Murrieta, Oceanside, Escondido, Encinitas, San Marco, and more. We have a long history of taking on insurance companies and securing the financial recovery our clients need to move forward.

Our Car Accident Lawyers in Temecula Offer Full-Service Legal Representation

From the day you hire us, we handle every part of your case from intake to settlement or verdict. That includes investigating the crash, preserving evidence, managing medical documentation, negotiating with insurance adjusters, and filing a lawsuit if needed. You’ll get direct access to your Temecula car accident attorney and regular updates—no call centers, no runaround.

We Win When You Win—No Fees Up Front

You don’t pay us unless we recover money for you. We work on a contingency fee basis, which means no upfront costs, no hourly rates, and no fees unless we win your case. It’s that simple.

We Take Pride in Our Proven Results for Southern California Clients

When you’re hurt in a car accident, you need a legal team with a record of real outcomes. At Sargent Law Firm, we fight to get every dollar our clients deserve, and our results reflect that commitment. Here are just a few of the car accident settlements we’ve secured for clients:

- $500,000 – Client suffered serious injuries in a I-15 highway crash near Barstow and was airlifted from the scene. After 3 years of pressure, the insurer paid their full policy limits.

- $425,000 – Our client required hip surgery and suffered a fractured back. Despite the insurer disputing the injury claims, we litigated and secured a strong settlement.

- $275,000 – Client was knocked unconscious and developed post-concussive syndrome. We built a solid case and recovered fair compensation.

- $235,000 – Client was seriously injured and transported by helicopter. We achieved a full policy limits settlement within 60 days.

- $180,000 – After a contested liability case involving a hip replacement surgery, we reached a favorable settlement without filing a lawsuit.

These results reflect just a small part of what we’ve achieved for car accident victims across California. If you’ve been injured in a crash, let Sargent Law Firm fight for the outcome you deserve. Contact a Temecula car accident lawyer from our firm today!

Types of Damages Our Injury Attorneys Could Recover in Your Temecula Car Accident Claim

One of the first questions you may ask our Temecula personal injury lawyers is what type of damages you can recover in your car accident claim. If you suffered injuries in a car accident and another driver was at fault, you could recover compensation for such damages as the following:

- Medical expenses

- Property damage, including replacing your vehicle

- Lost income

- Reduced income-earning potential

- Pain and suffering

- Emotional distress

- Loss of consortium

Losses in a car accident case are not limited to physical injuries. You can also recover compensation for the difficulties you face because of your injuries. Our car accident attorneys in Temecula, CA can help you determine which damages you can claim and guide you throughout the legal process.

Injuries You Can Get Compensation for in a Temecula Car Accident Claim

Severe car accident injuries can cause catastrophic injuries, and you may be entitled to compensation to cover the costs of medical treatment now and in the future. Whether you were a driver or a passenger in a Temecula motor vehicle accident, you could suffer any of the following types of injuries:

- Traumatic brain injury

- Spinal cord injury

- Full or partial paralysis

- Whiplash

- Broken bones

- Muscle sprains and strains

- Soft tissue injuries

- Internal bleeding and organ damage

- Loss of limb or amputation

The long-term effects of these injuries can create significant challenges in your daily life. You may lose crucial income while you recover, or you might be unable to return to the position you once held. Financial stress, in addition to physical injuries, can seem insurmountable. Rehabilitation costs alone can reach thousands of dollars.

You don’t have to face these challenges alone. Sargent Law Firm Injury Lawyers’ personal injury team can help you pursue justice and fair compensation for your losses. Our team has successfully obtained more than $40 million in settlements, judgments, and verdicts for our clients in Temecula and across California.

Get a free case evaluation

Schedule NowHow a Temecula Car Accident Lawyer from Sargent Law Firm Establishes Liability

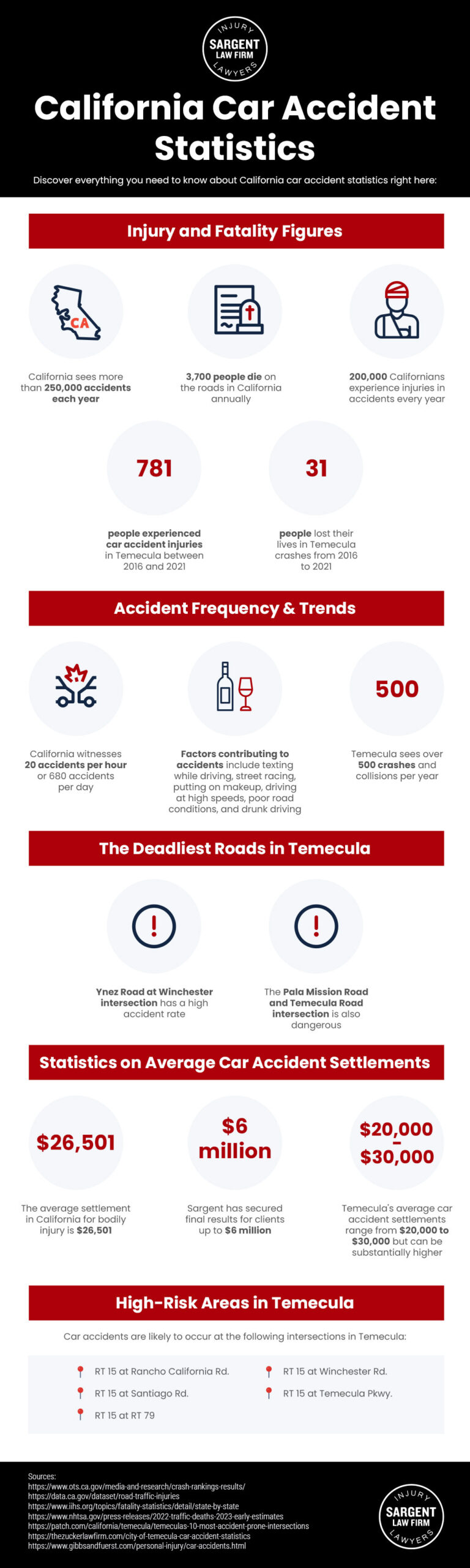

One of the most important parts of a Temecula car accident is establishing liability. After all, in California, your percentage of liability will affect the amount of your compensation. According to the National Highway Traffic Safety Administration (NHTSA), we spent $340 billion on traffic accidents in 2019. In California, traffic accidents can be the result of:

- Distracted driving

- Impaired driving

- Aggressive driving

- Fatigued driving

- Speeding

- Failure to yield the right of way

- Failure to obey traffic signals and signs

If we take your case, our Temecula accident attorneys can conduct a full investigation into the cause of your accident. By determining how the accident occurred, we establish who was at fault so that we can pursue compensation from the responsible party.

How Our Car Crash Lawyers in Temecula Can Help You with Your Injury Case

Our personal injury lawyer in Temecula, CA can help you pursue the compensation you deserve. While no law firm can guarantee a specific outcome, a skilled injury attorney knows how to maximize the compensation available to you so you do not leave any compensation on the table.

Our automobile accident lawyers in Temecula can help with:

- Making an insurance claim through the liable driver’s insurance policy

- Filing a personal injury lawsuit in court against the liable driver

- Filing a claim under your insurance policy, depending on your coverage

- Handling calls and correspondence about your personal injury claim

When we are on the case, we handle all the legal footwork so you can focus on recovery. We give you the legal support you need to move forward from the accident and adjust to your new normal.

Our Car Accident Lawyers in Temecula Can Gather Evidence to Prove Your Claim

The Temecula car accident lawyers at Sargent Law Firm Injury Lawyers do more than represent you during settlement negotiations or in court. We gather the evidence necessary to prove fault, verify the extent of your injuries, and calculate a fair value for the damages you suffered.

The evidence we may use to support your case includes:

- Medical records, including diagnostics and treatment plans

- Witness statements from individuals who observed the accident

- Police reports and crash reports for your accident

- Photos of the accident scene

- Videos from dashcams, traffic cameras, and CCTV

- Testimony from medical and economic experts

- Property repair and replacement estimates

- Invoices, receipts, bills, pay stubs, and financial statements

We may also request evidence specific to your case. For example, if your accident was due to a drunk driver, we may request blood alcohol content (BAC) results. Similarly, if you were struck by a commercial truck driver who was fatigued, we may request the operator’s driving log.

Our legal team has extensive experience investigating car accidents in Temecula and throughout California. Let us use our knowledge and experience to help you seek compensation for the losses you suffered.

Our Temecula Car Accident Attorney Will File Your Case Within the Statute of Limitations

CCP § 335.1 only allows you two years from the date of the Temecula accident to file a car accident injury lawsuit. This statute of limitations may vary depending on the circumstances of your car accident. If you miss legal deadlines, you could lose your chances for financial recovery.

Fortunately, we are aware of the time limits that apply to car accident claims. As our car crash attorneys in Temecula investigate your case and gather evidence, we keep your case on track by meeting all legal deadlines.

While we may file a lawsuit to avoid missing the statute of limitations, this does not necessarily mean your case will go to trial. Filing a timely lawsuit can, however, encourage insurance companies to settle rather than spend money on court fees and costs associated with a lawsuit.

Our Temecula Car Accident Lawyer Will Aggressively Negotiate for Your Settlement

In many cases, we help our clients negotiate a fair settlement with the insurance company without having to go to court. By presenting a strong case and aggressively advocating for your legal rights, we can often convince insurance carriers to provide a fair settlement; our case results speak for themselves in this regard.

Many personal injury cases settle out of court because insurance companies and corporations don’t want to spend money defending themselves during litigation. While we aim to settle out of court, our trial attorneys are always prepared to take your case before a judge and jury if it means obtaining a better settlement.

To find out more about how we can help you seek maximum compensation, call us or contact us online.

It’s free to speak with us and learn the value of your case today.

Call Us NowHow Much Is a Car Accident Settlement in Temecula, California?

The amount you can expect from a car accident settlement in Temecula, California, depends on various factors that are unique to each case. These factors can include how severe your injuries are, how much your medical expenses are, and how long it will take you to recover—or if you will ever recover at all. In general, the more severe the accident, the higher the compensation.

To get a better idea of what you can expect from your car accident settlement, you may want to consult with a personal injury attorney in Temecula who can go over the specifics of your case. We can evaluate your case, gather evidence, negotiate with insurance companies, and fight for the compensation you deserve.

You Don’t Need to Pay a Retainer to Hire a Sargent Law Firm Temecula Auto Accident Lawyer

When you sustain serious injuries in a car accident, you may face unprecedented financial difficulties. Although hiring a Temecula personal injury lawyer may seem outside your financial means, Sargent Law Firm Injury Lawyers can take your case at no upfront cost to you.

Rather than charging an hourly fee or holding a retainer, we wait to collect payment until we achieve a settlement or verdict. If we don’t win your case, we don’t get paid.

With that in mind, you can rest assured that we won’t take on a case if we don’t think it provides a sufficient monetary return to cover all your losses.

Get a Free Consultation With a Temecula Car Accident Lawyer from Our Firm Today!

At Sargent Law Firm Injury Lawyers, we are dedicated to holding the responsible parties accountable for their actions so you can obtain the money you deserve. When you hire our auto accident lawyers in Temecula, CA, we work tirelessly to recover fair compensation for your medical bills, lost income, and pain and suffering.

Don’t hesitate to contact us today to learn how we can assist you during a free case review. Our Temecula car accident attorneys are here to guide you through the legal process, from your initial consultation through the final settlement or verdict.

Temecula Car Accidents and Claims: Frequently Asked Questions Our Lawyers Answer

Get clear answers to common questions about car accidents and injury claims in Temecula. Our experienced lawyers explain your rights, the claims process, and how to maximize your compensation.

Is California A No-Fault State For Car Accident Claims?

California is NOT a no-fault state for car accidents. The state follows a traditional “fault” or “tort” system when it comes to auto insurance and accident claims. This distinction means that in a car accident claim in Temecula, the party determined to be at fault for causing the accident is financially responsible for the resulting damages and injuries.

Can I Hold the At-Fault Driver Liable for My Temecula Car Accident?

If you are injured in a car accident caused by another driver, you have the right to pursue a claim against the at-fault driver’s insurance company or file a personal injury lawsuit against the driver to seek compensation for your losses. Under California’s fault-based system, drivers are required to carry minimum liability insurance coverage.

If an accident occurs and the at-fault driver lacks sufficient insurance coverage or is uninsured, the injured party may be able to turn to their own uninsured/underinsured motorist coverage for compensation. Because California is a fault-based state, it may be a good idea to speak to a lawyer to take a closer look at liability in your claim if you want to protect your compensation.

Why Do the Victims of Car Accidents in California Deserve Compensation for Pain and Suffering?

Victims of car accidents in California deserve compensation for pain and suffering because these non-economic damages recognize the profound impact that injuries can have on a person’s quality of life. Pain and suffering encompass not just physical pain but also emotional distress, mental anguish, loss of enjoyment of life, and the overall burden of dealing with injuries and their consequences.

Unlike medical bills or lost wages, which can be easily quantified, pain and suffering acknowledges the intangible yet very real hardships that accident victims endure. This compensation serves to provide some measure of justice for the victim’s diminished quality of life and the challenges they face in recovery.

Compensation for pain and suffering is crucial because recovery from a car accident often involves a long and challenging journey that affects every aspect of a victim’s life. It may involve ongoing physical therapy, psychological counseling, and significant lifestyle changes. The stress of adapting to these changes, coupled with the physical discomfort of injuries, can be overwhelming.

By providing compensation for pain and suffering, California law acknowledges that money alone cannot fully restore what was lost, but it can provide resources for victims to seek additional support, explore alternative treatments, or make necessary life adjustments to cope with their new reality. This compensation is an important step in helping victims rebuild their lives and find a path forward after a traumatic event.

What Steps Should I Take to Protect My Rights After a Car Crash in Temecula?

After a car accident, your first consideration should be safety. Ensure everyone is out of harm’s way. Then, follow these steps to protect your safety and legal rights:

- Call emergency services: Call 911 to request emergency medical assistance and report the accident. The attending officer may take statements, contact details, and witness information when they arrive.

- Document the accident scene: Be sure to take photos of the vehicles involved, including license plates, make and model, and final resting places. Document the damage to all vehicles involved, as well as the scene.

- Report the accident to authorities: VEH § 16000 requires that all accidents involving injury, death, or property damage over $1,000 be reported. When you call 911, an officer should document the accident. If no officer responds, you must report it within 10 days.

- Seek medical attention: The adrenaline from your accident can mask serious injuries, so it is not safe to assume you are uninjured, even if you feel fine. Your doctor’s visits create critical medical records to support your car accident claim.

- Contact your insurance company: Insurance companies, even your own carrier, are motivated to reduce payouts and maximize their own profits. Before providing a formal statement, it may be best to speak with your auto accident attorney in Temecula, CA.

A car accident law firm in Temecula can help you avoid pitfalls that could reduce your settlement value. Let us handle communications with the insurance companies for you and guide you throughout the process.